Real estate investors need to stay abreast of market trends and key indicators for strategic decision-making. By monitoring economic factors, local demographics, housing inventory, and construction activity, they can predict property value shifts. Strategic Location Analysis, which considers accessibility, infrastructure, amenities, demographics, local economies, and market dynamics, helps identify high-growth areas. This enables investors to anticipate demand changes and strategically position their investments for long-term success in a competitive real estate market. Success requires strategic thinking, data analytics, and proactive decision-making to capitalize on opportunities while minimizing risks.

Real estate investors always seek an edge. In a competitive market, understanding market trends and strategic locations is no longer enough. To maximize returns, investors must employ effective strategies tailored to today’s dynamic landscape. This article guides you through the key indicators for real estate trends, the art of location analysis, and proven investment tactics to navigate and thrive in the current real estate scene.

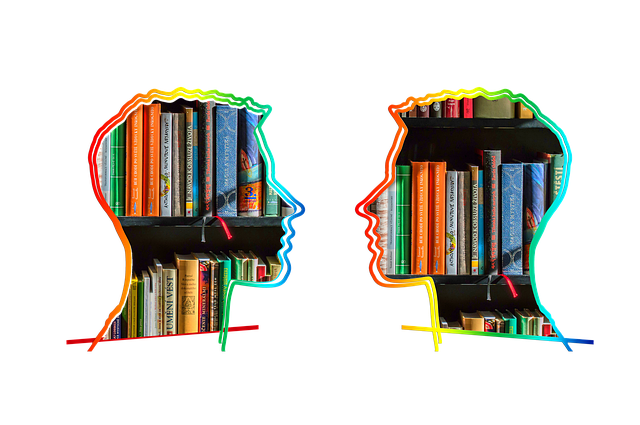

Understanding Market Trends: Key Indicators for Real Estate Investors

Real estate investors need to stay ahead of market trends to make informed decisions. Understanding key indicators is crucial for navigating the ever-changing real estate landscape. By closely monitoring economic factors, such as interest rates, unemployment figures, and inflation, investors can anticipate shifts in property values. Additionally, tracking local and regional demographics, housing inventory levels, and construction activity provides valuable insights into market dynamics.

Market trends often reveal hidden opportunities and potential risks. For instance, a growing population in a specific area may drive up demand for housing, while an excess of new constructions could lead to increased competition and lower prices. Staying informed allows investors to strategically position themselves, whether it’s investing in undervalued properties or capitalizing on emerging trends, ensuring they maximize returns in the dynamic real estate market.

Strategic Location Analysis: Unlocking Profitable Opportunities in Real Estate

Strategic Location Analysis is a powerful tool for real estate investors, offering a competitive edge in unlocking profitable opportunities. By carefully examining geographic factors such as accessibility, infrastructure development, and proximity to amenities, investors can identify areas with high growth potential. For instance, regions with improving transportation networks or upcoming commercial projects often experience increased property values and tenant demand.

This analysis also involves understanding demographic trends, local economies, and market dynamics. Investors who stay informed about these aspects can anticipate shifts in real estate demands and make informed decisions. Ultimately, a thorough Strategic Location Analysis enables investors to pinpoint lucrative areas, ensuring their real estate investments are well-positioned for success.

Effective Investment Strategies: Maximizing Returns in the Competitive Market

In today’s competitive real estate market, investors must adopt effective strategies to maximize returns and stay ahead of the curve. One key approach is to focus on location; understanding local trends and identifying areas with high growth potential can lead to significant gains. Investing in up-and-coming neighborhoods or regions with strong economic prospects often yields better outcomes than simply following popular demands. Diversification is another powerful strategy, spreading investments across various property types and sectors to mitigate risks and capitalize on different market segments.

Additionally, real estate investors should leverage data analytics and market research to make informed decisions. By studying historical trends, demographic shifts, and economic indicators, investors can anticipate market movements and adapt their strategies accordingly. Staying proactive, flexible, and well-informed allows for seizing emerging opportunities while minimizing potential losses in this dynamic landscape.